The World in 2025 and Looking to 2026

It is not an exaggeration to say that 2025 was one of the most consequential years for U.S. foreign policy in decades. In my view, there have been a few major shifts in American foreign policy doctrine over the last thirty years, each tied to how the United States understood its own power and responsibilities.

The first shift came with the end of the Cold War. The collapse of the Soviet Union ushered in a period of undisputed U.S. hegemony and a broad commitment to policing global hotspots, underwriting the global economy, and acting as a guarantor of democracy and stability. This defined U.S. foreign policy under George H. W. Bush and Bill Clinton.

The next shift was more circumstantial and contingent. After 9/11, U.S. foreign policy was completely reshaped around the global war on terror. The Department of Homeland Security was created in one of the largest reorganizations of the federal government in history. Diplomacy, intelligence, and defense were reorganized around a single overriding goal: preventing another catastrophic terrorist attack on U.S. soil.

As ISIS collapsed and militant Islamism was suppressed across the Middle East, terrorism receded as the dominant threat. What followed was a period of drift. There was something of a return to Clinton-era assumptions, combined with growing unease about emerging great power competition. The older balance-of-power approach that predates the Cold War existed, but it wasn’t articulated explicitly, and was barely mentioned a decade ago.

Joe Biden, the only non–baby boomer president of the post–Cold War era, but from the generation before, attempted to impose structure on this uncertainty. His administration framed global politics as a hybrid Cold War, organized around competition with China across rigid democratic and authoritarian blocs. Only with Trump 2.0 has the paradigm of global great power competition been fully embraced, stripped of moral framing and treated as an operating principle rather than a theoretical concern.

Major takeaways from 2025

The United States has shifted decisively toward a transactional, balance-of-power foreign policy.

Donald Trump’s temperament fits a multipolar world more naturally than alliance-based liberal internationalism

U.S. grand strategy looks out for number one, rather than sustaining global order.

Tariffs have become a standing tool of leverage rather than a temporary disruption.

Industrial policy and AI-driven supply chains now sit at the center of U.S. foreign policy.

China has begun flexing its muscle on the international stage, and seeks to be a global leader like the United States.

Europe is moving toward strategic autonomy quickly, but negotiations over Ukraine will drag on.

Russian influence globally is weakening, with its hold in the Caucasus and Central Asia evaporating.

The Middle East is shifting from perennial disruption to stability as Iran and its proxies have been decisively defeated.

Trump-style imperialism, an extension of his interpretation of the Monroe Doctrine, will become more blatant.

The Trump Card on Grand Strategy

Donald Trump is transactional by nature, and that quality gives U.S. foreign policy the appearance of volatility. He pivots quickly when he believes a better deal is available and treats relationships as permanently negotiable. That style may be destabilizing in an alliance-based system built on trust and predictability, but it maps cleanly onto a multipolar environment where power and leverage dominate.

In practice, this resembles an older model of international politics. The late nineteenth century offers the closest parallel, when great powers negotiated spheres of influence and imposed outcomes on smaller states with little pretense of shared rules. You can see echoes of this logic in Ukraine negotiations, where discussions increasingly resemble bargaining over influence rather than debates over sovereignty or international law.

Trump’s lack of a coherent ideological framework is not accidental. Beyond immediate advantage, there is little evidence that he views foreign policy as a moral project. Issues that do not produce direct or visible returns struggle to hold his attention. USAID is a clear example. Where previous administrations treated development assistance as long-term investment in stability and influence, Trump sees it as spending without payoff.

This temperament feeds directly into U.S. grand strategy. As long as Trump remains president, the United States is likely to continue pushing responsibility outward. Ukraine is increasingly framed as a European problem. U.S. allies in the Pacific are expected to take on more responsibility for managing China. The United States, in turn, concentrates more on the Western Hemisphere and on the economic foundations of power.

Outside these primary theaters, competition for resources is intensifying, particularly in Africa and the developing world. The key shift is conceptual. Economic resilience and geopolitical influence are no longer treated as separate domains. They are understood as a single system. Ironically, this resembles the more holistic approach of China to foreign affairs.

Tariffs, Technology, and Industry

Tariffs have been one of the defining features of Trump’s second term. After the shock of the Liberation Day tariffs, a more durable pattern emerged. Rather than provoking a unified response against the United States, tariffs pushed many countries into bilateral negotiations for exemptions and concessions.

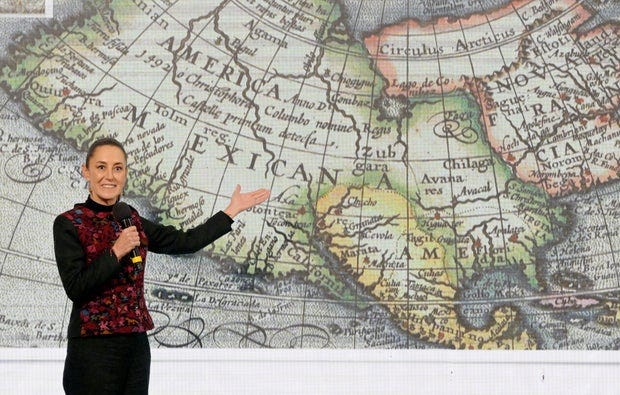

The episodes with Mexico and Canada illustrate the limits of this approach. In Mexico’s case, President Sheinbaum pushed back effectively, exposing how quickly leverage erodes when tariff threats are used repeatedly. In Canada, stronger leadership made negotiations more difficult rather than easier. Over time, governments learn how to manage transactional pressure.

In 2026, tariffs are likely to remain a baseline condition for access to U.S. markets. What they are unlikely to produce is large-scale reshoring. Supply chain decisions unfold over decades, not presidential terms. Many firms will simply wait, assuming that tariffs will be rolled back once Trump leaves office. Comprehensive trade deals are very complex and take years to fully negotiate, so any concessions will likely be temporary.

Where the shift appears most durable is in industrial policy. Critical minerals, advanced manufacturing, and energy infrastructure have moved from niche policy debates to central concerns. This change predates Trump, but his administration has accelerated it. The AI economy magnifies this trend. AI systems require enormous amounts of energy, advanced chips, and stable access to mineral supply chains.

These dependencies create chokepoints, and chokepoints create leverage. That leverage increasingly shapes foreign policy decisions. The result is a geoeconomic framework in which trade, security, and industrial planning cannot be separated. This is not ideological convergence with China so much as convergence driven by structural necessity.

Regional Outlooks

China and East Asia

East Asia remains the most dangerous theater in the international system. China continues to focus on its first island chain, including Taiwan, using various tactics to gradually reduce U.S. influence without triggering open conflict. Japan’s increasingly explicit language on Taiwan matters because Beijing reads it as a shift toward treating Taiwan as sovereign rather than contested.

In response, China has intensified probing behavior around Japan, the Philippines, and the broader Pacific while carefully calibrating escalation. The likely pattern in 2026 is more testing rather than rupture: incremental advances designed to become difficult to reverse, paired with restraint meant to avoid a decisive U.S. response.

Ukraine and Europe

The war in Ukraine has proven far harder to end than early rhetoric by the Trump administration suggested. While U.S. aid has continued, new packages have become more politically contested, and Trump has publicly expressed frustration with Putin and Zelensky as negotiations failed to produce a clean off-ramp. Meanwhile, other actors’ security interests have begun to assert themselves more openly.

Germany’s decision to loosen fiscal constraints to raise defense spending, and moves by France and the UK toward independent security guarantees for Ukraine, signal a Europe that is beginning to act strategically rather than defer reflexively to Washington. A peace deal now appears further away than it did a year ago, as Russia continues VERY incremental advances and Ukraine strikes deeper inside Russian territory. The most recent proposal resembles capitulation more than settlement, and it is unlikely to hold.

The Middle East

The Middle East is entering a different phase, marked less by open regional war than by uneasy political restructuring. Iran and its broader network have been constrained relative to previous years, while momentum toward a Gaza settlement has grown. The Gulf States appear focused on economic development rather than revisiting old conflicts.

Emerging security frameworks increasingly point toward removing direct responsibility over Gaza from Israel and placing it in a broader regional or international arrangement, but the West Bank remains a far more difficult challenge, with no clean solution. Syria’s consolidation suggests some long-running conflicts may finally be burning out, but the region is stabilizing.

Latin America

Latin America represents the largest wildcard in U.S. foreign policy heading into 2026. Venezuela in particular carried significant escalation risk. The current strategy of blockades and sanctions enforcement resembled the early stages of a coercive campaign. This post was initially drafted prior to Nicolo Maduro’s capture and removal, and I’ll soon have a more detailed analysis of this unprecedented action my U.S. special forces.

I was concerned an open conflict with Venezuela would strain U.S. relations across the Western hemisphere and undermine Washington’s effort to assert influence close to home. Trump appears to be using a coercive strategy to gain control, and while some countries might welcome the removal of a bad actor, they might also be wary of putting too much trust in the U.S.

Looking Toward 2026

The defining feature of 2026 will be continuity of transformation. The United States is moving deeper into a transactional, multipolar world as its relative power declines, China becomes more of an international player, and multiple other countries rise to a tier just below the two heavyweights. Soft power is eroding. Hard power is more constrained. Leverage is replacing diplomacy.

The open question is whether this transition can be managed strategically, or whether impulse will substitute for design. We are not fully through the looking glass yet, but the assumptions that governed U.S. foreign policy for the past three decades are gone. The coming year will show whether the United States can adapt to this new reality without accelerating its (relative) decline.